CMC Markets专栏: 黄金的潜在技术形态解图

如有更多问题,欢迎致电:澳大利亚免费中文电话:1300 668 268

开设免费模拟账户,无风险演练交易

Investing in CFDs carries significant risks and is not suitable for all investors. Losses can exceed your deposits. You do not own, or have any interest in, the underlying assets. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The information in this Market Commentary has been prepared by CMC Markets using information from external sources, believed to be accurate and reliable at the time it was sourced. It is general information only. Neither CMC Markets, its subsidiaries, nor any director, employee or agent of CMC Markets gives any guarantee, representation or warranty as to the reliability, accuracy or completeness of the information contained in the Market Commentary, nor accepts any responsibility or liability arising in any way (including by reason of negligence) for errors in, or omissions from, the information in the Market Commentary to the fullest extent permitted by law. In preparing this Market Commentary, CMC Markets did not take into account your objectives, financial situation and needs. Consequently, you should consider the information in light of your objectives, financial situation and needs. It's important for you to consider the relevant Product Disclosure Statement ('PDS') and any other relevant CMC Markets Documents before you decide whether or not to acquire any of the financial products. Our Financial Services Guide contains details of our fees and charges. All of these documents are available at cmcmarkets.com.au or you can call us on 1300 303 888.

相关阅读

-

银行股稳中整理 军工与周期性板块接力走强 澳股大盘再创历史新高

尽管联邦银行(CBA)等金融权重股近期出现回调,澳大利亚股市仍在军工板块及铁矿石、煤炭、锂矿等周期性资源股的带动下,于本月中旬再度刷新历史高位。

-

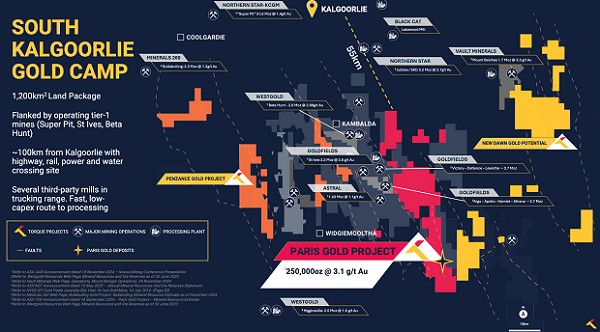

【异动股】Torque Metals (ASX:TOR) Paris项目截获5米27.93克/吨黄金矿段 矿化向西大幅延伸

专注西澳州黄金勘探的Torque Metals Ltd (ASX股票代码:TOR) 股价异动,周四飙涨27.50%。澳华财经在线数据库显示,TOR最新价0.255澳元,已发行股本5.27亿股,市值1.34亿澳元。公司最新披露的账面现金余额为470万澳元。

-

最新市值1.68亿澳元 坐拥淘金圣地610万盎司黄金资源量 机构称黄金开发商 Theta Gold Mines Ltd(ASX: TGM)具估值潜力

随着黄金期货和现货价格创出历史新高,ASX澳交所拥有已探明黄金资源量的黄金公司,纷纷加快旗下金矿项目向生产开采阶段的迈进。拥有610万盎司JORC标准黄金资源量(平均品位4.17g/t)、市值尚为1.58亿澳元的黄金开发商 Theta Gold Mines Ltd(ASX: TGM),便是其中最新一家。

-

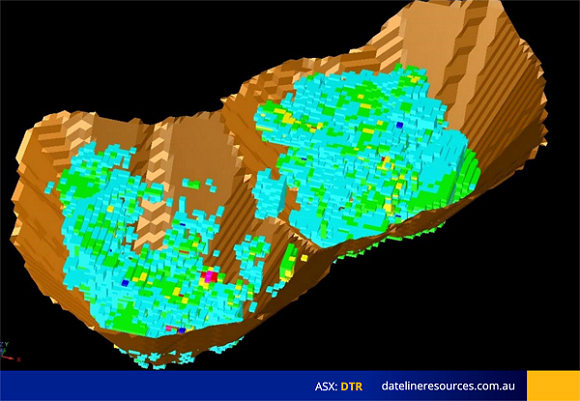

【异动股】3个月暴涨13倍!Dateline Resources (ASX:DTR)美国黄金稀土项目备受瞩目股价持续飙升

Dateline Resources Ltd (ASX股票代码:DTR) 股价异动,周二飙涨26.26%。Dateline Resources位于美国加州100%自有的Colosseum项目与附近的Mountain Pass矿场具有相似地质特征,被视为具有稀土勘探潜力。

-

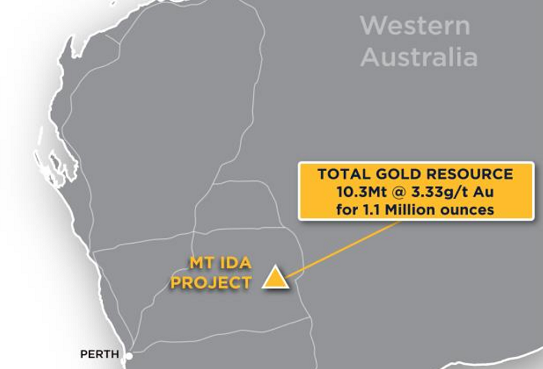

【新股上市】金矿勘探公司Ballard Mining (ASX:BM1)澳交所首秀暴涨48%

Ballard Mining Ltd (ASX股票代码:BM1) 周一(7月14日)澳交所首秀,终盘暴涨48.00%,报收0.37澳元。锂业公司Delta Lithium Limited(ASX:DLI)剥离旗下位于西澳州Goldfields地区的Mt Ida项目全部黄金资产,打包置入Ballard Mining并成功推动BM1实现 IPO上市。

-

【异动股】Falcon Metals Ltd (ASX:FAL)暴涨97%:Blue Moon首个楔形孔钻得543克/吨超高品位黄金矿块

Falcon Metals Ltd (ASX股票代码:FAL)股价异动,上周五暴涨97.37%。澳华财经在线数据库显示,FAL最新价0.375澳元,已发行股本1.77亿股,市值6638万澳元。截止一季度末公司账面现金结余835万澳元。

-

澳洲金矿企业仍被低估 配置黄金资产或带来丰厚回报

黄金基金Victor Smorgon表示,尽管金价持续上涨,但澳洲金矿企业仍被低估。在当前全球宏观经济波动的背景下,黄金具有较低的波动性和避险属性,建议投资者将5%-10%的资产配置于黄金。

-

黄金板块艳压群雄年度涨幅逾五成 “黄金再次货币化”驱动估值重塑浪 个股表现或现分化

FY25财年澳交所(ASX)500家成分股中,涨幅居前的50家公司中21家为黄金概念股,涨幅前10企业中黄金股更是占据8席;黄金正悄然迎来“再次货币化”的新时代,眼下正处于一个脱离美元主导格局的“分水岭”——全球贸易体系正在重塑对实物资产的需求结构,黄金作为最重要的非主权实物资产之一,其战略价值正在被重新认识。

免责声明:本网所发所有文章,包括本网原创、编译及转发的第三方稿件及评论,均不构成任何投资建议,交易操作或投资决定请询问专业人士。

热门点击

-

- 银行股稳中整理 军工与周期性板块接力走强 澳股大盘再创历史新高

-

- 【7.28】今日财经时讯及重要市场资讯

-

- 【7.31】今日财经时讯及重要市场资讯

-

- 【7.30】今日财经时讯及重要市场资讯

-

- 【7.29】今日财经时讯及重要市场资讯

-

- 澳交所小盘锂矿股7月集体飙升见证情绪复苏 锂市场波动中隐现触底行情

-

- 特朗普计划实施15%至20%统一关税 对澳关税或翻倍

-

- 2026财年指引大幅低于预期 铀矿股Boss Energy (ASX:BOE)周一股价放量暴跌逾四成

-

- 【8.1】今日财经时讯及重要市场资讯

-

- 矿企Fortescue创始人发表主题文章 强调中澳成为气候盟友符合澳大利亚国家利益

-

- 汇丰银行全球战略调整再迈新步伐 计划抛售澳洲零售银行业务

-

- 两华男涉主谋诈骗洗钱案在悉尼赌场被捕

-

- Bubs Australia(ASX:BUB)任命乔·库特(Joe Coote)为新任首席执行官

-

- 获联邦银行大力支持 澳洲预制房屋建筑行业方兴未艾

-

- 特朗普暂停“小额豁免”引发在线奢侈品零售商Cettire(ASX:CTT)股价暴跌