Recce Pharmaceuticals Secures China Patent for Lead Anti-Infectives, Strengthening Global IP Strategy

Recce Pharmaceuticals secures Chinese patent acceptance for its flagship anti-infective compounds, expanding its global IP footprint into the world’s second-largest pharmaceutical market.

( Image: ACB News)

█ ACB News Cathy

SYDNEY, 27 May 2025 – Recce Pharmaceuticals Ltd (ASX: RCE), an Australian biotech developing next-generation synthetic anti-infectives, has received official notification from the China National Intellectual Property Administration (CNIPA) confirming the acceptance of its core Patent Family 4, valid until 2041.

The newly accepted patent covers RECCE® 327 and RECCE® 529, including their manufacturing processes, therapeutic applications for bacterial and viral infections, and multiple delivery formats (oral, injection, transdermal, aerosol, etc.).

This is Recce’s fifth Patent Family 4 grant, following approvals in Australia, Canada, Israel, and Japan. Additional international applications under the Patent Cooperation Treaty (PCT) are under review.

CEO James Graham welcomed the decision, stating it marks a significant expansion of Recce’s global IP portfolio into China, the world’s second-largest pharmaceutical market, where the antibiotic sector alone is valued at US$4.09 billion and forecast to grow at a 5.7% CAGR through 2030.

Recce’s pipeline includes:

● R327: IV/topical therapy for drug-resistant bacterial infections

● R435: Oral antibacterial

● R529: Antiviral therapy

All three compounds have been recognised by the WHO and the FDA, with R327 receiving QIDP status, Fast Track designation, and 10-year post-approval market exclusivity.

Recce owns and operates its own automated manufacturing facility in Australia, supporting current clinical trials and future commercial supply.

This patent marks a key step in Recce’s global commercialisation strategy and its efforts to combat the global threat of antimicrobial resistance.

Copyright Notice:

ACB News reserves full copyright over all articles explicitly marked as "original" content.

No media outlet, corporate website, platform, or app within Australia may reproduce, excerpt, adapt, or republish such content in any form without prior written authorization from ACB News.

Any unauthorized use or reproduction—including via third-party platforms—will be considered an infringement. ACB News reserves the right to pursue legal action against any such violations.

相关阅读

-

Recce Pharmaceuticals中国专利获批 拓展全球抗感染新药知识产权布局

Recce首席执行官 James Graham 表示:“感谢中国国家知识产权局对Recce抗感染技术优势的认可。此次专利获批标志着我们全球知识产权组合的重要扩展,覆盖至全球第二大医药市场。”

-

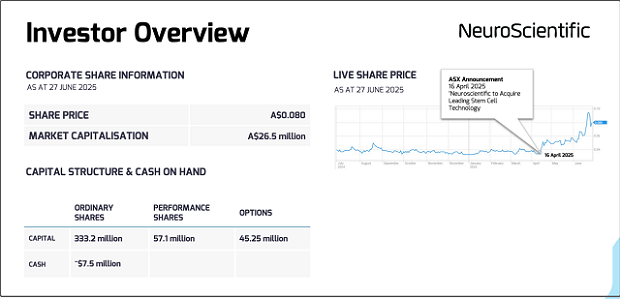

【异动股】收购MSC干细胞疗法技术引发股价暴涨 Neuroscientific Biopharmaceuticals (ASX:NSB) 加速克罗恩病临试研究

神经免疫疾病生物医学创新公司Neuroscientific Biopharmaceuticals Ltd (ASX股票代码:NSB) 股价异动,周四飙涨16.67%。自4月中旬披露收购间充质干细胞 (MSC) 治疗技术StemSmart以来,NSB股价上涨348.72%。

-

【异动股】Clarity Pharmaceuticals(ASX:CU6)前列腺癌靶向铜疗法获3项美国FDA快速通道资格

放射性癌症药物研发公司Clarity Pharmaceuticals Ltd (ASX股票代码:CU6)股价异动,周二飙涨15.32%。澳华财经在线数据库显示,CU6最新价2.56澳元,已发行股本3.21亿股,市值8.23亿澳元。截止一季度末,公司账面现金结余9510万澳元。

-

【异动股】Island Pharmaceuticals (ASX:ILA)登革热治疗药将迎关键临试结果

抗病毒药物开发公司Island Pharmaceuticals Ltd (ASX股票代码:ILA)股价异动,周四劲涨9.09%。澳华财经在线数据库显示,ILA最新价0.18澳元,已发行股本2.1亿股,市值4205万澳元。截止一季度末,公司账面现金结余482万澳元。

-

Aft Pharmaceuticals (ASX:AFP)中国市场获突破:2024年全球制药公司在华19起许可交易中独占2起

澳交所上市医药研发制造与分销公司Aft Pharmaceuticals Ltd (ASX股票代码:AFP)向投资者表示,2024年由全球性制药公司授权许可在中国市场发行的19种已开发药物中AFP占到2种,分别为与海南海药(000566.SZ)合作分销的防腐霜药物Crystaderm®...

-

获美国FDA同意 澳药物研发公司Paradigm Biopharmaceuticals(ASX:PAR)携手Advanced Clinical 推动骨关节炎疼痛治疗临床3期试验

ASX澳交所上市的临床后期药物研发公司Paradigm Biopharmaceuticals Ltd(ASX:PAR)近期发布公告称,已选定Advanced Clinical为其首选临床研究机构(CRO),以支持公司目前正在推进的骨关节炎疼痛治疗临床3期研究(PARA_OA_012)。

-

丹麦制药巨头诺和诺德通过并购布局心血管领域

据腾讯自选股消息,当地时间周一,丹麦制药巨头诺和诺德宣布,将以10.3亿欧元的价格收购Cardior Pharmaceuticals。该公司专注于基于非编码...

-

生物制药公司Neuren Pharmaceuticals开发新药在美净销售额猛增 三年内股价飙升近十倍

根据生物制药公司Neuren Pharmaceuticals(ASX:NEU)发布消息,鉴于其开发新药DAYBUE在美国的净销售额出现猛增,预计该公司将得到更大特许权使用费回报。

免责声明:本网所发所有文章,包括本网原创、编译及转发的第三方稿件及评论,均不构成任何投资建议,交易操作或投资决定请询问专业人士。

热门点击

-

- 银行股稳中整理 军工与周期性板块接力走强 澳股大盘再创历史新高

-

- 【7.28】今日财经时讯及重要市场资讯

-

- 【7.29】今日财经时讯及重要市场资讯

-

- 2026财年指引大幅低于预期 铀矿股Boss Energy (ASX:BOE)周一股价放量暴跌逾四成

-

- Bubs Australia(ASX:BUB)任命乔·库特(Joe Coote)为新任首席执行官

-

- Boss Energy 股价放量暴跌逾四成2026财年指引大幅低于预期

-

- 澳洲最新《各州经济表现报告》出炉 西澳连续四个季度蝉联榜首

-

- 澳洲增长型养老基金上财年投资收益颇丰 前20名回报率达到或超过10.4%

-

- 中国国家育儿补贴方案公布!3周岁前每娃每年3600元

-

- Sprintex与广东葆德科技签署930万澳元自有品牌供应协议 进军中国水产养殖市场

-

- 上海市委书记陈吉宁会见澳大利亚总理阿尔巴尼斯

-

- Vital Metals完成Tardiff矿床初步研究,稀土项目展现强劲经济潜力

-

- 2025财年澳洲股票基金排行榜出炉 前五名收益率均超20%

-

- 【异动股】Calix (ASX:CXL)获澳洲可再生能源署4490万澳元拔款用于建设绿色钢铁示范工厂

-

- 中国(山东)-澳大利亚 经贸合作对接会在悉尼成功举办