US Market Watch | Dow Eyes 45,000 Amid Tentative June Rebound

█ By ACB News / David Niu | 9 June 2025

( Image: ACB News)

Following a volatile correction earlier this year, US equities have staged a strong comeback since mid-April. The Dow, Nasdaq, and S&P 500 all posted impressive gains in May—among the best monthly performances in years.

Despite this strength, investors remain cautious. The Dow Jones Industrial Average has yet to break past its previous high, and macro risks—ranging from stagflation concerns to tariff impacts—continue to weigh on sentiment.

Last week’s phone call between Chinese President Xi Jinping and US President Donald Trump provided a boost to markets, with the Dow surging past its March peak. However, whether this signals the start of a new bull phase remains to be seen.

Tiger Trade App

After a volatile decline in February, US equities began rebounding from mid-April, with all three major indices recording one of the strongest May performances in recent decades. However, despite the recovery, investor sentiment remains cautious, and US indices have yet to break new highs like Germany’s DAX.

Technically, the Dow Jones Industrial Average (DJIA) could test the 45,000 level in the coming weeks if momentum holds. But confirmation of a new bullish cycle still requires more decisive signals.

Last Friday, US markets surged after news of a phone call between the Chinese and US presidents, with the DJIA touching 42,924 intraday—a new high in the current rebound and a break above the March mid-point peak.

This marks a continuation of the upward trend that started in mid-April, with all three major indices showing upward momentum. Yet compared to Germany’s stock market, which continues to post record highs, Wall Street’s rebound remains cautious and lacks breakout strength.

Behind this "cautious rebound" lies a complex mix of macro uncertainties—ranging from inflation and interest rates to geopolitics and tariff concerns. As ACB News noted in its recent coverage, global equities in May did not experience the typical “Sell in May and go away” pattern, possibly due to the sharp correction seen in late March and early April.

Our earlier reports, such as “Black Monday Hits Global Equities” and “Stay Long-Term Committed: Market Correction Opens New Window for China Assets,” reflected that the March-April downturn was likely a pricing-in of risks.

On 3 March, with the Dow closing at 43,840, ACB News published a technical analysis suggesting a potential 4th-wave correction if the index had already peaked at 45,073 without reaching its measured 47,000 target. Given the previous 2nd-wave correction of roughly 8,000 points, a retracement to the 120-week MA (~37,000) was technically plausible.

Indeed, by 7 April, the DJIA had dipped to 36,611.78—a drawdown of over 8,400 points—technically satisfying the requirements of a medium-term correction. Since mid-April, US markets have rebounded steadily.

May delivered strong gains: the Dow added 3.94%, while the Nasdaq and S&P 500 surged 9.56% and 6.15%, respectively.

However, despite the rebound, the indices have not broken past their prior highs. Technically, the market remains in a consolidation phase, with no definitive signal of a new upward cycle.

On the fundamentals side, several key developments demand attention. In mid-May, Moody’s downgraded the US government’s credit rating from AAA to AA1. Surprisingly, markets continued rising. JPMorgan Chase CEO Jamie Dimon warned at the bank’s annual Investor Day that markets might be “too complacent.”

He pointed to ballooning fiscal deficits, potential stagflation risks, and underappreciated tariff impacts. He also noted that earnings expectations may face downward revisions over the next six months.

On the geopolitical front, positive momentum came from renewed China-US engagement. On 5 June, Chinese President Xi Jinping and US President Donald Trump held a 90-minute call agreeing to implement the Geneva consensus and push for a new round of trade talks.

Global media responded positively. US markets rallied on Friday, with the DJIA’s intraday peak of 42,924 breaking above its mid-March high.

Meanwhile, US IPOs continue to attract significant capital. CoreWeave surged over 200%, eToro gained ~30% on debut, and Circle—despite raising pricing guidance—still jumped 168% on Day 1, peaking up 300%.

In the AI sector, NVIDIA’s strong earnings further boosted investor sentiment.

Looking ahead, if current momentum holds, the DJIA may test the 45,000 mark, and possibly challenge the January high. Whether US markets can match Germany’s breakout to new records before the end of H1 2025 remains to be seen.

Key Market Watchpoints:

- Fed’s June policy statement and forward rate guidance;

- Revisions to corporate earnings forecasts;

- Progress in China-US trade negotiations;

- USD Index and US Treasury yield movements.

Australia Market Brief:

In Australia, the ASX200 rose 0.96% last week, closing at 8,515.70—just 50 points shy of its February all-time high.

Despite a pullback in the final two sessions, the overall trend remains upward. If global risk appetite stays constructive, the ASX may soon retest record levels. Select sectors and stocks—especially those with low-volume pullbacks after strong prior rallies—deserve attention, particularly where fundamentals and volume trends align.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any securities. Readers should conduct their own research or consult a professional advisor before making investment decisions.

相关阅读

-

联邦银行裁减45个工作岗位 首次将AI列为主因

澳大利亚联邦银行(CBA)称,已经裁撤了45个呼叫中心的工作岗位,并首次明确将人工智能(AI)的发展列为裁员原因。联邦银行在澳洲有38,000名员工,其中大约3000名在呼叫中心工作。

-

Bubs Australia(ASX:BUB)任命乔·库特(Joe Coote)为新任首席执行官

Bubs Australia Limited(ASX代码:BUB)7月28日宣布,正式任命乔·库特(Joe Coote)为公司首席执行官,即日起生效。库特先生是一位经验丰富的国际企业高管,在快速消费品(FMCG)、乳制品及婴幼儿营养领域拥有超过20年的深厚管理背景。

-

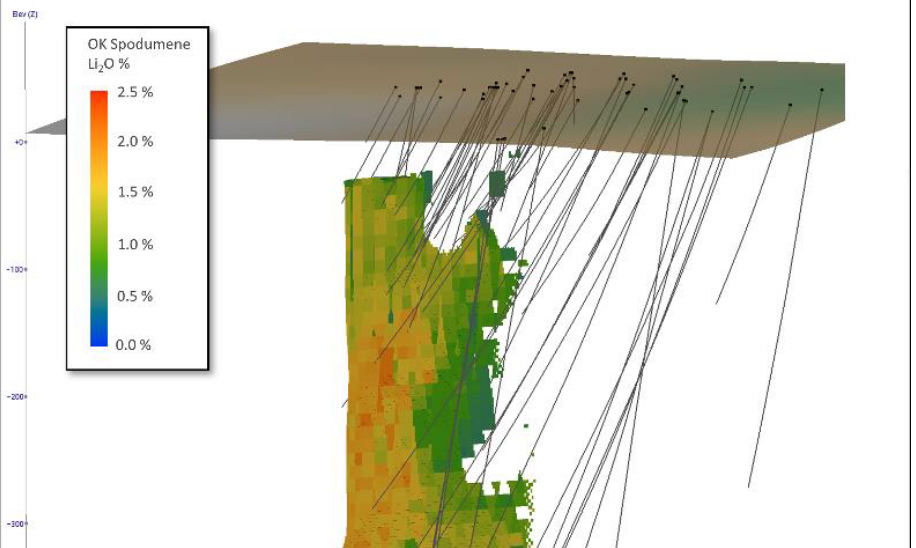

【异动股】单日暴涨4成!Lithium Plus Minerals (ASX:LPM)扎实推进 Lei锂项目监管与环境审批 静待市场复苏迎接开发决策

在澳洲北领地从事锂开发和黄金勘探的Lithium Plus Minerals Ltd (ASX股票代码:LPM) 股价大幅异动,周三暴涨39.68%。

-

【异动股】红酒集团Au stralian Vintage (ASX:AVG) 转型进行时 加速减库存推动现金流增长

澳洲红酒公司Australian Vintage Ltd (ASX股票代码:AVG) 股价异动,周三飙涨20.88%。自一周前宣布弃租葡萄园以落实减库存策略以来,Australian Vintage股价上扬近40%。

-

特斯拉全球首家超级充电站餐厅落地洛杉矶 人形机器人Optimus首次上岗服务

本地时间2025年7月21日,特斯拉宣布其全球首家超级充电站餐厅(Supercharger Diner)在美国洛杉矶正式开业。餐厅设有超过250个座位,7X24小时运营,为顾客提供美食、娱乐与充电服务的全新综合体验。现场配备80个V4超级充电桩,专为特斯拉车主打造高效便捷的充电环境。

-

【7.15】今日财经时讯及重要市场资讯

澳大利亚总理阿尔巴尼斯周一出席中澳钢铁减碳圆桌会议,携必和必拓(BHP)、力拓(Rio Tinto)、福特斯克金属集团(Fortescue)及汉考克勘探公司(Hancock Prospecting)等大型矿企高管,与中国宝武、鞍钢等钢企高管举行会谈。

-

加拿大钨矿商登陆纳斯达克股价首日走高 融资背后藏国防大单

钨矿商Almonty Industries Inc.纳斯达克上市首日股价走高。截至发稿,Almonty股价报4.77美元,高于4.50美元的发行价。知情人士透露,此次...

-

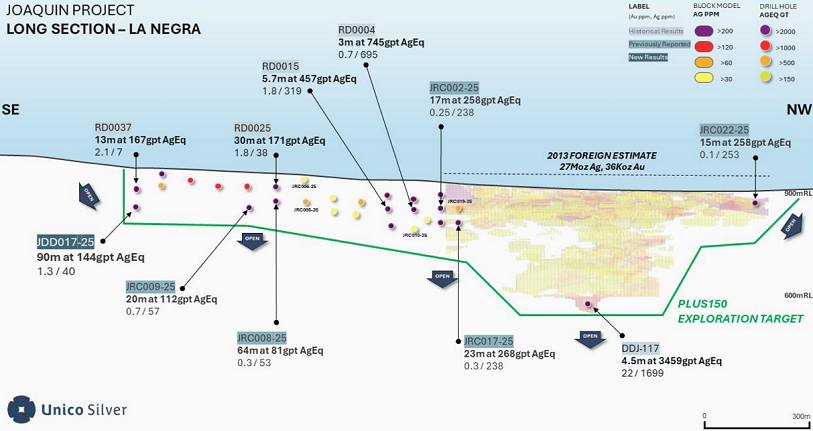

【异动股】Unico Silver (ASX:USL) 阿根廷La Negra矿床拓展钻探发现浅表高品位银矿

Unico Silver Ltd (ASX股票代码:USL) 股价异动,周一飙涨28.79%。澳华财经在线数据库显示,USL最新价0.425澳元,已发行股本4.38亿股,市值1.86亿澳元。截止一季度末公司账面现金结余1980万澳元。

免责声明:本网所发所有文章,包括本网原创、编译及转发的第三方稿件及评论,均不构成任何投资建议,交易操作或投资决定请询问专业人士。

热门点击

-

- 银行股稳中整理 军工与周期性板块接力走强 澳股大盘再创历史新高

-

- 【7.28】今日财经时讯及重要市场资讯

-

- 【7.29】今日财经时讯及重要市场资讯

-

- 2026财年指引大幅低于预期 铀矿股Boss Energy (ASX:BOE)周一股价放量暴跌逾四成

-

- 【7.30】今日财经时讯及重要市场资讯

-

- 特朗普计划实施15%至20%统一关税 对澳关税或翻倍

-

- Bubs Australia(ASX:BUB)任命乔·库特(Joe Coote)为新任首席执行官

-

- 矿企Fortescue创始人发表主题文章 强调中澳成为气候盟友符合澳大利亚国家利益

-

- Boss Energy 股价放量暴跌逾四成2026财年指引大幅低于预期

-

- 澳洲最新《各州经济表现报告》出炉 西澳连续四个季度蝉联榜首

-

- 中国国家育儿补贴方案公布!3周岁前每娃每年3600元

-

- 澳洲增长型养老基金上财年投资收益颇丰 前20名回报率达到或超过10.4%

-

- Vital Metals完成Tardiff矿床初步研究,稀土项目展现强劲经济潜力

-

- 2025财年澳洲股票基金排行榜出炉 前五名收益率均超20%

-

- 【异动股】Calix (ASX:CXL)获澳洲可再生能源署4490万澳元拔款用于建设绿色钢铁示范工厂