Bowen Coking Coal (ASX: BCB) Hits FY25 Output Target Early, Seeks Funding in Trading Halt

( Image: ACB News)

By ACB News Stock Market Editorial Team

While The company confirmed it had achieved its full-year FY25 run-of-mine (ROM) coal production and sales guidance , Bowen’s share price declined sharply prior to the trading halt, closing at A$0.096 on 23June, with the company’s market capitalisation falling at about A$10 million — a sharp contrast to the hundreds of millions it was valued at during the COVID-era peak.

ACB News|25 June 2025 — ASX-listed coal producer Bowen Coking Coal Ltd (ASX: BCB) announced on Tuesday, 24 June 2025, that it has requested a trading halt on its securities to advance funding discussions in response to continued coal market weakness and ongoing royalty pressures in Queensland.

The company confirmed that as of May 2025, it had achieved its full-year FY25 run-of-mine (ROM) coal production and sales guidance, with one month remaining in the financial year. Key operational highlights to date include:

——ROM coal production of 304,000 tonnes in May — the highest monthly output recorded for FY25.

——Year-to-date ROM production of 2.7 million tonnes and coal sales of 1.7 million tonnes

——Year-to-date FOB unit costs (excluding royalties) of A$150.6 per tonne

The company reaffirmed its aim to achieve the high end of its FY25 ROM coal production and coal sales guidance, and the low end of its FOB unit cost guidance for the year ending 30 June 2025.

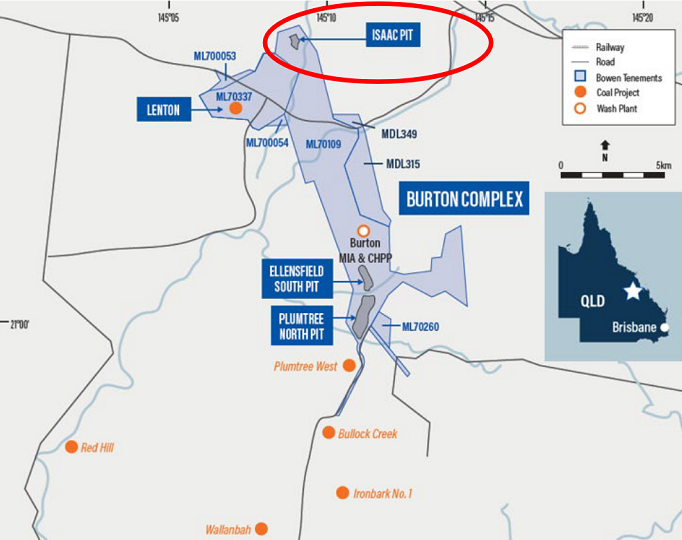

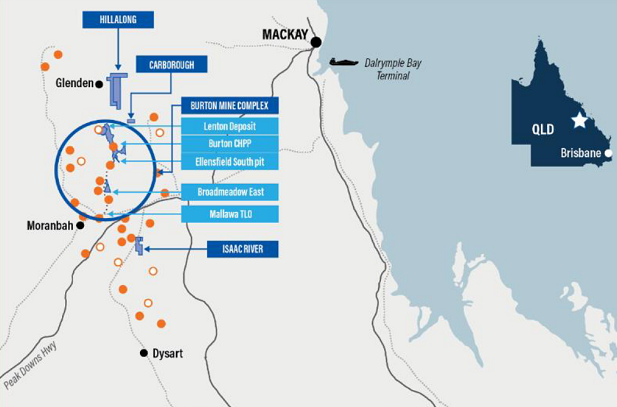

The company also reaffirmed that its Burton Mine Complex will transition to an owner-operator model from 1 July 2025, with operations to be managed internally. The transition is part of Bowen’s broader strategy to navigate ongoing pressure in global coal markets.

According to the latest update, the Platts Australia PLV metallurgical coal index has declined by 25% year-on-year to US$175/t, while API5 thermal coal is currently trading at approximately US$66/t.

The company highlighted the financial impact of Queensland’s progressive coal royalty regime, introduced in July 2022, which applies marginal royalty rates based on sale price brackets:

——Up to A$100/tonne: 7%

——A$100–150: 12.5%

——A$150–175: 15%

——A$175–225: 20%

——A$225–300: 30%

——Above A$300: 40%

Under this framework, any coal sold above A$175/tonne is subject to significantly higher marginal royalty payments, adding pressure to operating margins.

To maintain its current scale of operations and facilitate the Burton transition, Bowen is evaluating a range of funding options including debt, equity and hybrid instruments. The company also stated that if near-term funding is not secured and/or coal market conditions do not improve, it may consider temporarily pausing part or all of the operations at the Burton Mine Complex.

The trading halt took effect prior to market open on Tuesday, 24 June 2025, and is expected to remain in place until trading resumes on Thursday, 26 June 2025, or until an earlier announcement is made.

Prior to the trading halt, Bowen’s share price declined sharply, closing at A$0.096 on 23June, with the company’s market capitalisation falling at about A$10 million — a sharp contrast to the hundreds of millions it was valued at during the COVID-era peak.

In April 2025, Bowen completed a 1-for-100 share consolidation. Following the consolidation, the company’s revised share capital stands at approximately 107.8 million shares on issue.

Disclaimer

The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. While every effort is made to ensure accuracy, we do not guarantee the completeness, reliability, or timeliness of any content. Investment involves risk. Always seek independent, professional advice before making any financial decisions.

相关阅读

-

Bowen Coking Coal(ASX: BCB)申请自愿停牌,推进债务重组与融资谈判

Bowen Coking Coal Limited(ASX: BCB)今日向澳大利亚证券交易所申请对公司证券实施自愿停牌,以支持当前关键债务重组及融资安排的推进工作。

-

提前完成财年煤炭产量指引的Bowen Coking Coal(ASX:BCB)最新市值千万澳元 停牌以推进融资安排

停牌前Bowen Coking Coal(ASX:BCB)大幅下挫,最新$0.096澳元股价对应市值在1,000万澳元左右,和2022年数亿澳元市值形成鲜明对比。

-

【异动股】Bowen Coking Coal (ASX:BCB)昆州Burton综合体北部矿坑煤炭资源量储量大幅扩增

Bowen Coking Coal Ltd (ASX股票代码:BCB) 位于昆州中部中鲍文盆地的Burton煤炭矿山综合体迎来资源量扩增的积极消息,综合体北端Isaac矿坑的煤炭储量和资源量分别增长170万吨和240万吨,推动整个项目总的煤炭储量和资源量分别达到1650万吨和1.107亿吨。

-

【异动股】Bowen Coking Coal (ASX:BCB) 飙涨14%:产煤成本持续下降 稳态经营策略显效

昆州煤炭生产商Bowen Coking Coal Ltd (ASX股票代码:BCB) 季报显示,今年第三季度公司共生产毛煤近77万吨、商品煤44万吨。当季共销售煤炭41.5万吨,受市场行情影响,实际平均售价同比下降5%,至216澳元每吨。

-

【9.18】今日财经时讯及重要市场资讯

9月15日,澳中博览会在墨尔本会展中心盛大开幕,这一重要活动受到了澳中两国政商的大力支持。澳大利亚前贸易部长Andrew Robb担任澳中博览会主席并致辞,中国驻墨尔本代总领事曾建华出席并发言。

-

澳能源部长Chris Bowen:澳大利亚减排目标面临“挑战” 未来十年内电动飞机和绿氢产业将为助力

澳大利亚能源部长克里斯·鲍文(Chris Bowen)在上周五的一次碳市场研究所(Carbon Market Institute)峰会上表示,未来十年内,电动飞机和绿氢产业将有助于澳大利亚实现其2050年净零碳排放目标。

-

市场预计工党工业排放改革大概率落地 大型企业入场推高澳洲碳信用交易量

过去一周来,随着更多大型企业入场,澳大利亚碳信用交易量已跃升超过50%。

-

澳洲商会抢推经济计划 呼吁审计政府支出

澳大利亚商会(BCA)于周三推出一份经济改革计划,对政府雄辩滔滔却不采取实质行动提升生产率的做法提出批评,并告诫称联邦政府财长鲍文(Chris Bowen)不应在即将发布的经济声明中增加临时性专项减支措施,对政府支出进行全面的审计才是当务之急。

免责声明:本网所发所有文章,包括本网原创、编译及转发的第三方稿件及评论,均不构成任何投资建议,交易操作或投资决定请询问专业人士。

热门点击

-

- 项目现金流预计超5亿美元、估值远低于同行 计划2027年初投产的Theta Gold Mines Ltd(ASX: TGM)或将迎来估值拐点

-

- 全球供应链牌桌上,澳大利亚正沦为盘中餐

-

- 【异动股】签署1.25亿澳元反无人机激光技术订单 Electro Optic Systems (ASX:EOS)股价应声暴涨再飙四成!

-

- 【8.4】今日财经时讯及重要市场资讯

-

- 【8.5】今日财经时讯及重要市场资讯

-

- 【8.6】今日财经时讯及重要市场资讯

-

- 【8.7】今日财经时讯及重要市场资讯

-

- 重卡换电第一股Janus Electric(ASX:JNS)季报观察:下季度工时被全部预订 确立800台重卡市占目标 商业化拓展蓄势而发

-

- 中国加强个人境外收入监管 境外买卖股票收入也要缴税

-

- 重卡换电第一股Janus Electric(ASX:JNS)季报观察:下季度工时被全部预订 确立800台重卡市占目标 商业化拓展蓄势而发

-

- 【8.8】今日财经时讯及重要市场资讯

-

- 连续降息预计触发周期性行情 澳交所小盘股有望显著受益

-

- 【月度回顾】7月ASX科技板块涨幅居前 人工智能概念引燃个股 iSynergy飙升1000%

-

- 【月度回顾】7月ASX医疗股强势反弹9% 领涨各大行业板块 6支个股翻倍上行

-

- 【异动股】Al军事软件公司Xreality Group (ASX:XRG)暴涨32%:与德州公共安全部签署570万澳元合同大单