Australian Stock Market Hits Record High in Wednesday Morning Trade – ASX 200 Index Touches 8,639 Points Amid Broad-Based Market Momentum

( Image: ACB News)

█ By ACB News / David Niu | 11 June 2025

In an exclusive report published on Monday titled “[U.S. Market Watch] Wall Street Rises at Start of June, Dow Could Head Towards 45,000 – Further Signals Needed to Confirm Trend”, we noted that despite a late-week pullback, the overall trend of the Australian equity market remained upward.

If global markets continue to maintain a positive risk appetite, the Australian share market appears well-positioned to push for further record highs. Particular attention should be paid to sectors and individual stocks that have undergone meaningful corrections—especially those that previously rallied on high volumes and then consolidated on lower volumes. Fundamental developments and volume dynamics in these areas merit close monitoring.

On Wednesday, the ASX indeed delivered a fresh all-time high as anticipated.

During morning trade section on 11 Jun Wed , the ASX 200 index reached 8,639 points, surpassing the previous high of 8,615 points recorded on Valentine’s Day (February 14), setting a new record for the benchmark index.

On Wednesday, 11 June, the ASX 200 index surged to an all-time high of 8,639 points during the morning trading session, surpassing the previous high of 8,615 set on Valentine’s Day (14 February).

One notable feature of this week’s market activity is the resurgence of trading momentum across key sectors and select individual stocks, indicating a broadening of investor participation.

As highlighted in “ASX Ends May on a High Note! ACB News Weekly Wrap-up of Listed Company Updates and Market News (2025/6/2)”, the divergence in May between the index and many individual stock performances had become increasingly stark. Continuation of this trend could weigh on investor sentiment and confidence.

The gold sector, however, has been a notable exception. Supported by elevated gold futures and spot prices, several gold stocks remain among the market’s top performers year-to-date.

Some gold exploration companies—such as Barton Gold Holdings Ltd (ASX: BGD) and Solstice Minerals Ltd (ASX: SLS)—have seen strong recent momentum. Both stocks have reached all-time highs since listing, outperforming the broader market, as they progress into new exploration phases with potential drill results expected soon.

Meanwhile, advanced-stage gold developers like Meeka Metals Ltd (ASX: MEK), which have already delineated mineral resources and are entering mining and processing stages, continue to show resilient upward trends in the secondary market.

The lithium sector, after nearly two years of significant corrections, has also shown tentative signs of a turnaround. Pilbara Minerals Ltd (ASX: PLS) touched multi-year lows last week but has since rebounded with renewed trading volume.

On Wednesday, PLS rose 6.67%, bringing its month-to-date gain to approximately 14%. If the current rally continues with solid volume, it will be important to watch whether the stock can break above long-term downtrend resistance levels.

In a late-May exclusive titled “[Exclusive] Trump’s ‘New Nuclear Policy’ Ignites Uranium Market – Can the Rally in Uranium Stocks Continue?”, we pointed out that U.S. nuclear policy reforms had ignited renewed interest in the uranium sector. On Tuesday, shares of Paladin Energy Ltd (ASX: PDN) and uranium enrichment technology firm Silex Systems (ASX: SLX) hit fresh year-to-date highs. However, both pulled back on Wednesday, and the sector’s near-term outlook will likely be shaped by movements in uranium oxide prices.

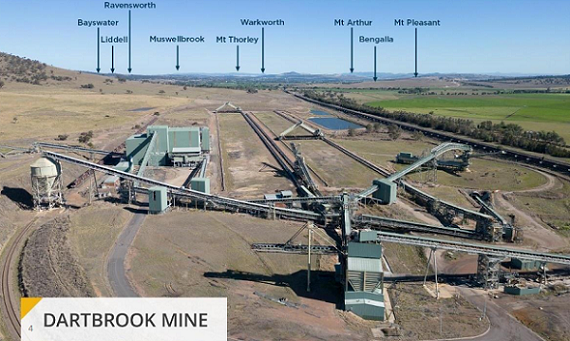

The coal sector has also seen a resurgence in trading activity. Since last week, Coronado Global Resources Inc (ASX: CRN) experienced abnormal trading volume and a sharp price rebound. Within just a few sessions, its share price surged from AUD 0.10 to an intraday high of AUD 0.225 on Tuesday. However, after touching that level, the stock fell sharply and closed down 8.11%, forming a large bearish candlestick—suggesting the rally may be facing near-term selling pressure or entering a consolidation phase. (See: “[Stock on the Move] Coronado Global Resources Inc (ASX: CRN) Signs $150 Million Refinancing Deal with Oaktree Capital”)

Going forward, whether trading activity and volume across sectors and individual stocks can remain elevated will be critical in assessing the next phase of the market’s direction.

As noted in our Monday exclusive, if global risk appetite remains positive, the Australian market could retain the momentum to test further highs. Stocks and sectors that have undergone deep corrections—particularly those supported by solid fundamentals and rising volumes—warrant closer observation.

Some popular thematic stocks , such as antimony mining stocks that had previously shown strength, have seen notable pullbacks this week—possibly signaling the start of a short-term consolidation phase.

It is worth noting that over the past two years, each time the index hit a new high, the market often experienced a period of volatility and pullback afterwards. Whether this new high will trigger a similar pattern remains to be closely watched.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any securities. Readers should conduct their own research or consult a professional advisor before making investment decisions.

相关阅读

-

【异动股】红酒集团Au stralian Vintage (ASX:AVG) 转型进行时 加速减库存推动现金流增长

澳洲红酒公司Australian Vintage Ltd (ASX股票代码:AVG) 股价异动,周三飙涨20.88%。自一周前宣布弃租葡萄园以落实减库存策略以来,Australian Vintage股价上扬近40%。

-

【异动股】破产托管后股价过山车 煤炭股Australian Pacific Coal( ASX:AQC)剧烈反弹420%

煤炭公司Australian Pacific Coal Ltd ( ASX股票代码:AQC)频频异动,自主要资产陷入破产托管股价深度跳水后,AQC周二暴力反弹420.00%,且成交量飙至4084万股。

-

【异动股】Australian Strategic Materials (ASX:ASM)开售高纯度稀土材料 韩国金属厂询盘增加

致力于打造中国市场之外替代性稀土材料供应链的Australian Strategic Materials Ltd (ASX股票代码:ASM) 股价异动,周五飙涨27.09%。

-

【异动股】中国稀土出口禁令引发Australian Strategic Materials(ASX:ASM)股价飙涨 Dubbo项目显现“替代性”优势

Australian Strategic Materials Ltd (ASX股票代码:ASM)股价异动,周一再度飙涨18.03%。澳华财经在线数据库显示,ASM最新价0.72澳元,已发行股本1.81亿股,市值1.31亿澳元。截止四季度末,公司账面现金结余3260万澳元。

-

澳洲股票基金一季度表现令人失望 最高收益率仅3.7%

2025年第一季度,由于澳大利亚股市的表现创疫情以来最差开局,澳洲股票基金的收益普遍下跌。根据美世咨询(Mercer)进行的投资绩效调查,今年一季度,超过85%的澳洲股票基金出现亏损。在125只基金中,仅有17只实现正回报。

-

惊曝黑客攻入澳最大养老金公司会员账户 已有基金确认会员资金被窃数十万澳元!

如果您是澳大利亚退休金基金(AustralianSuper)的会员,请尽快通过安全方式登陆并查询账户情况,如果账户异常甚至账户余额为零,切勿惊慌,请联系基金客服。

-

【3.13】今日财经时讯及重要市场资讯

澳大利亚证券和投资委员会(ASIC)周三发布公告称,已经将澳大利亚最大的养老基金AustralianSuper告上法庭,指控其在处理近7,000起死亡抚恤金理赔时存在严重延误。

-

ASIC将AustralianSuper告上法庭 指控其拖延死亡抚恤金理赔

澳大利亚证券和投资委员会(ASIC)周三发布公告称,已经将澳大利亚最大的养老基金AustralianSuper告上法庭,指控其在处理近7,000起死亡抚恤金理赔时存在严重延误。

免责声明:本网所发所有文章,包括本网原创、编译及转发的第三方稿件及评论,均不构成任何投资建议,交易操作或投资决定请询问专业人士。

热门点击

-

- 银行股稳中整理 军工与周期性板块接力走强 澳股大盘再创历史新高

-

- 【7.28】今日财经时讯及重要市场资讯

-

- 【7.29】今日财经时讯及重要市场资讯

-

- 2026财年指引大幅低于预期 铀矿股Boss Energy (ASX:BOE)周一股价放量暴跌逾四成

-

- 【7.30】今日财经时讯及重要市场资讯

-

- 特朗普计划实施15%至20%统一关税 对澳关税或翻倍

-

- Bubs Australia(ASX:BUB)任命乔·库特(Joe Coote)为新任首席执行官

-

- 矿企Fortescue创始人发表主题文章 强调中澳成为气候盟友符合澳大利亚国家利益

-

- Boss Energy 股价放量暴跌逾四成2026财年指引大幅低于预期

-

- 澳洲最新《各州经济表现报告》出炉 西澳连续四个季度蝉联榜首

-

- 中国国家育儿补贴方案公布!3周岁前每娃每年3600元

-

- 澳洲增长型养老基金上财年投资收益颇丰 前20名回报率达到或超过10.4%

-

- Vital Metals完成Tardiff矿床初步研究,稀土项目展现强劲经济潜力

-

- 2025财年澳洲股票基金排行榜出炉 前五名收益率均超20%

-

- 【异动股】Calix (ASX:CXL)获澳洲可再生能源署4490万澳元拔款用于建设绿色钢铁示范工厂