Flagship Minerals Raises A$4m, Secures A$2.5m Strategic Investment from Shandong Xinhai to Advance Pantanillo Gold Project

█ |By ACB News Stock Market Editorial Team

ACB News, Sydney 2 Oct 2025, Flagship Minerals Limited (ASX: FLG) announced on Tuesday that it had secured binding commitments to raise A$4.0 million (before costs) via a strongly supported share placement, including a cornerstone A$2.5 million investment from Shandong Xinhai Mining Technology & Equipment Inc, one of the world’s leading mining engineering, procurement and construction (EPC) groups, to fast-track development of its Pantanillo Gold Project in Chile.

The placement was priced at A$0.10 per share, representing a 28.6% discount to Flagship’s last closing price of A$0.14 and a 5.7% discount to the 10-day VWAP of A$0.106.

Xinhai’s investment will be delivered in two equal tranches of A$1.25 million, with the second tranche subject to the completion of a site visit to Pantanillo, the finalisation of a strategic partnership agreement and the appointment of Xinhai’s nominee as a non-executive director on Flagship’s board.

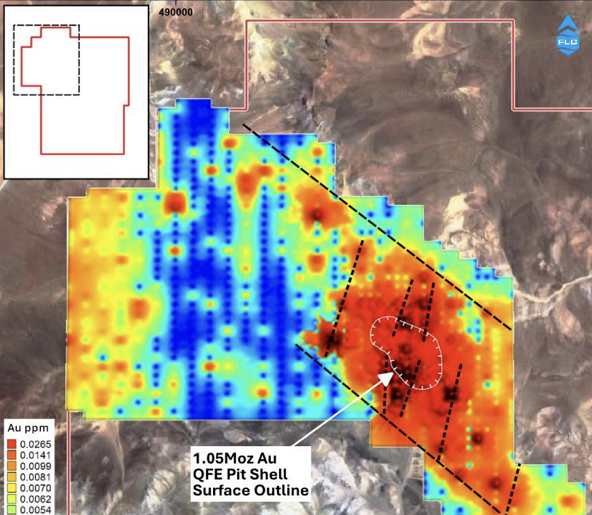

Proceeds will be directed to the conversion of the current NI 43-101 qualifying foreign estimate of 1.05Moz into a JORC (2012) Mineral Resource Estimate, metallurgical testwork and heap leach studies, drilling to support a resource update in 2026, and initial feasibility work. The company also intends to apply funds to working capital, ensuring momentum in its development program.

For Flagship, the partnership with Xinhai is significant beyond the financing. Xinhai has executed more than 500 EPC contracts globally, many including full mine construction and operations, and has built a growing presence in Latin America where it has supplied equipment to over 30 copper and gold projects and provided EPC services to more than 10. Its equity interest, technical expertise and board representation are expected to reduce execution risk and provide Flagship with access to proven capabilities in metallurgy, mineral processing, engineering and project financing.

Managing Director Paul Lock said the oversubscribed placement breaks the cycle of short-term option funding and positions the company to advance Pantanillo through feasibility and into development. He emphasised that Xinhai’s involvement represents a major step forward, combining financial capacity with technical strength to unlock a low-capex, near-term production opportunity. Flagship’s goal is to define sufficient resources to support open pit mining and heap leach processing capable of producing around 100,000 ounces of gold per year for more than a decade.

The latest placement builds on progress announced last week, when Flagship’s review of the extensive dataset acquired from Anglo American Norte SpA highlighted further expansion opportunities. Drill intercepts demonstrated broad mineralised widths, with many holes ending in mineralisation, indicating scope for down-dip and near-surface extensions. The review supports the interpretation of a mineralised corridor more than 500 metres wide, with potential to grow the current foreign estimate and enhance the project’s scale.

Flagship has secured an option to acquire 100% of the Pantanillo project, an advanced strategic gold play in Chile’s Maricunga Belt surrounded by tier-one majors and supported by world-class infrastructure. With the strategic partnership now in place, the company is positioned to accelerate the conversion of resources, advance feasibility studies and pursue development.

Disclaimer

The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. While every effort is made to ensure accuracy, we do not guarantee the completeness, reliability, or timeliness of any content. Investment involves risk. Always seek independent, professional advice before making any financial decisions.

相关阅读

-

Flagship Minerals (ASX: FLG): Why Pantanillo’s Value Thesis Is Starting to Reprice

From resource quality to engineering cadence, the project narrative is shifting beyond explorationBy David Niu | A...

-

【公司观察】百万盎司只是起点:从资源质量到工程节奏 Flagship Minerals(ASX: FLG)Pantanillo金矿的价值逻辑正在重写

印象中,悉尼一位长期跟踪澳洲矿业股的资深投资者曾总结道:衡量一家矿业公司的长期价值,关键从来不只是“有没有资源”,而在于资源品位是否足够扎实、资源量是否具备扩展空间,更重要的是——项目是否已经从“讲资源故事”,迈入能够用工程路径与资金逻辑加以验证的阶段。

-

尽调圆满完成! 山东鑫海125万澳元二期注资到位 Flagship Minerals (ASX:FLG)智利Pantanillo金矿项目宣告启动环评基线研究 3至6周完成JORC资源估算更新

Flagship Minerals Ltd (ASX股票代码:FLG)战略股东、全球性矿业工程服务企业中国山东鑫海矿业技术装备股份有限公司(以下称“山东鑫海”)12月中旬派出五名高级代表对FLG旗舰资产智利Pantanillo金矿项目展开实地考察。

-

继山东鑫海战略进驻后 Flagship Minerals Limited(ASX: FLG)智利项目所在区迎来长期供水解决方案

正在推进智利Pantanillo金矿项目开发的澳交所上市公司Flagship Minerals Limited(ASX: FLG),本周迎来其项目所在地——智利马里昆加(Maricunga)金矿带重大基础设施进展的重磅消息:智利阿塔卡马大区近日正式通过了 ENAPAC Ruta Este 海水淡化输水工程的环境影响研究(EIS)。这项投资规模达 15 亿美元的基础设施,被视为马里昆加金矿带过去十年来最重要的区域性利好之一。

-

Flagship Minerals(ASX:FLG)承接英美资源集团智利项目资料库 Pantanillo金矿项目历史钻芯取样将发中国鑫海测试 延伸钻探与资源升级筹备中

澳交所金矿勘探开发公司Flagship Minerals Limited(ASX:FLG)周二宣布,公司已于11月1日正式承接了英美资源集团(Anglo American)位于智利北部矿业城市科皮亚波(Copiapó)的仓库,并在其后完成了Pantanillo金矿首批历史钻芯冶金测试样品的制备工作。

-

Flagship Minerals (ASX:FLG)智利Pantanillo金矿项目土壤数据揭示5 X 1.2公里大面积金异常

澳交所上市矿业公司Flagship Minerals Ltd (ASX股票代码:FLG) 对最近从英美资源集团(Anglo American)购买的Pantanillo金矿项目数据集进行审查过程中,不断在百万盎司级的Pantanillo北部矿床周围和沿线发现额外的勘探机遇。

-

Flagship Minerals Raises A$4m, Secures A$2.5m Strategic Investment from Shandong Xinhai to Advance Pantanillo Gold Project

ACB News, Sydney 2 Oct 2025, Flagship Minerals Limited (ASX: FLG) announced on Tuesday that it had secured binding commitments to raise A$4.0 million (before costs) via a strongly supported share placement, including a cornerstone A$2.5 million investment from Shandong Xinhai Mining Technology & Equipment Inc, one of the world’s leading mining engineering, procurement and construction (EPC) groups, to fast-track development of its Pantanillo Gold Project in Chile.

-

山东鑫海斥资250万澳元战略入股Flagship Minerals( ASX: FLG) 助力智利Pantanillo金矿项目推进

澳交所上市矿业公司 Flagship Minerals Limited(ASX: FLG)周二宣布已获得有约束力的承诺,将通过定向增发融资 400万澳元。其中 250万澳元增发额度,获中国山东鑫海矿业技术装备股份有限公司(“鑫海”)战略认购。

免责声明:本网站信息仅供一般参考,不构成投资或财务建议。虽力求准确与完整,但不保证信息的准确性、完整性或时效性。投资有风险,决策前请咨询专业独立顾问。使用本网站即视为接受本免责声明。

热门点击

-

- 澳最大银行CBA就约10亿澳元可疑贷款展开调查 事件引发对经纪渠道风控关注

-

- 中东冲突持续避险情绪升温 全球股市震荡 上证综指今日创出10余年历史新高

-

- 中东战火点燃风险溢价 3月股市或处于“水深火热”之中

-

- Moonlight(ASX: ML8)上市两个月交出首份勘探结果 钻钻皆见金矿化! 剑指半年内界定黄金资源量目标

-

- 【异动股】获最大股东四川和邦生物追投880万澳元 Avenira (ASX:AEV)澳洲Wonarah磷项目加足马力全力筹备2026年矿石直运

-

- 【异动股】山东国瓷材料拟以1.66亿澳元收购澳洲老牌牙科用品公司SDI (ASX:SDI)

-

- 【美股观察】 中东战火点燃风险溢价 道指50512点后的四浪窗口正在开启?3月股市或处于“水深火热”之中(上篇)

-

- 【异动股】镓矿勘探公司Nimy Resources (ASX:NIM)高管随西澳矿产石油部长赴美访问

-

- 【异动股】转型稀土综合企业 Lindian Resources (ASX:LIN)收购在产混合稀土碳酸盐工厂 预计Q4投入一体化运营

-

- 2月财报季ASX医疗股表现不佳 板块整体下跌13% 哪些个股脱颖而出?

-

- 政策红利叠加渠道订单:Janus Electric(ASX: JNS)重卡电动化商业拓展有望进入加速期

-

- 【3.2】今日财经时讯及重要市场资讯

-

- 【3.3】今日财经时讯及重要市场资讯

-

- 【3.5】今日财经时讯及重要市场资讯

-

- 【3.4】今日财经时讯及重要市场资讯