Bowen Coking Coal (ASX: BCB) Hits FY25 Output Target Early, Seeks Funding in Trading Halt

( Image: ACB News)

By ACB News Stock Market Editorial Team

While The company confirmed it had achieved its full-year FY25 run-of-mine (ROM) coal production and sales guidance , Bowen’s share price declined sharply prior to the trading halt, closing at A$0.096 on 23June, with the company’s market capitalisation falling at about A$10 million — a sharp contrast to the hundreds of millions it was valued at during the COVID-era peak.

ACB News|25 June 2025 — ASX-listed coal producer Bowen Coking Coal Ltd (ASX: BCB) announced on Tuesday, 24 June 2025, that it has requested a trading halt on its securities to advance funding discussions in response to continued coal market weakness and ongoing royalty pressures in Queensland.

The company confirmed that as of May 2025, it had achieved its full-year FY25 run-of-mine (ROM) coal production and sales guidance, with one month remaining in the financial year. Key operational highlights to date include:

——ROM coal production of 304,000 tonnes in May — the highest monthly output recorded for FY25.

——Year-to-date ROM production of 2.7 million tonnes and coal sales of 1.7 million tonnes

——Year-to-date FOB unit costs (excluding royalties) of A$150.6 per tonne

The company reaffirmed its aim to achieve the high end of its FY25 ROM coal production and coal sales guidance, and the low end of its FOB unit cost guidance for the year ending 30 June 2025.

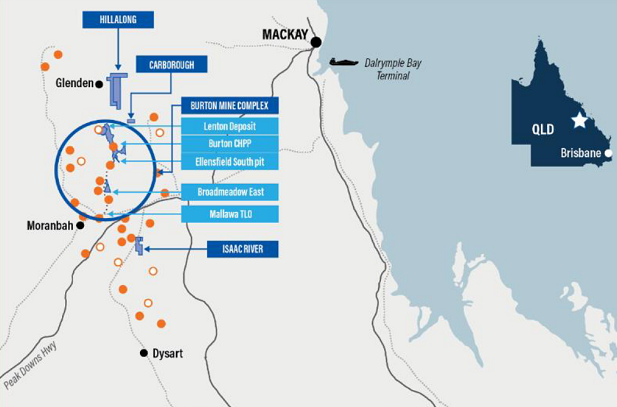

The company also reaffirmed that its Burton Mine Complex will transition to an owner-operator model from 1 July 2025, with operations to be managed internally. The transition is part of Bowen’s broader strategy to navigate ongoing pressure in global coal markets.

According to the latest update, the Platts Australia PLV metallurgical coal index has declined by 25% year-on-year to US$175/t, while API5 thermal coal is currently trading at approximately US$66/t.

The company highlighted the financial impact of Queensland’s progressive coal royalty regime, introduced in July 2022, which applies marginal royalty rates based on sale price brackets:

——Up to A$100/tonne: 7%

——A$100–150: 12.5%

——A$150–175: 15%

——A$175–225: 20%

——A$225–300: 30%

——Above A$300: 40%

Under this framework, any coal sold above A$175/tonne is subject to significantly higher marginal royalty payments, adding pressure to operating margins.

To maintain its current scale of operations and facilitate the Burton transition, Bowen is evaluating a range of funding options including debt, equity and hybrid instruments. The company also stated that if near-term funding is not secured and/or coal market conditions do not improve, it may consider temporarily pausing part or all of the operations at the Burton Mine Complex.

The trading halt took effect prior to market open on Tuesday, 24 June 2025, and is expected to remain in place until trading resumes on Thursday, 26 June 2025, or until an earlier announcement is made.

Prior to the trading halt, Bowen’s share price declined sharply, closing at A$0.096 on 23June, with the company’s market capitalisation falling at about A$10 million — a sharp contrast to the hundreds of millions it was valued at during the COVID-era peak.

In April 2025, Bowen completed a 1-for-100 share consolidation. Following the consolidation, the company’s revised share capital stands at approximately 107.8 million shares on issue.

Disclaimer

The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. While every effort is made to ensure accuracy, we do not guarantee the completeness, reliability, or timeliness of any content. Investment involves risk. Always seek independent, professional advice before making any financial decisions.

相关阅读

-

【11.5】今日财经时讯及重要市场资讯

据澳大利亚贸易和旅游部声明,该部部长唐方睿已率澳大利亚企业代表团赴上海参加中国国际进口博览会(下称进博会)。据悉,此次参加进博会的澳大利亚企业达256家,创下历史新高。

-

澳能源部长宣布“太阳能共享”计划 拟为澳洲家庭提供免费太阳能电力

澳大利亚能源部长克里斯·鲍文(Chris Bowen)周二宣布,阿尔巴尼斯政府将推出一项名为“太阳能共享”计划的零售能源优惠政策,向澳大利亚家庭提供每天至少三个小时的免费太阳能电力。

-

澳能源部长访华行程:预将聚焦低碳产品投资与出口议题

澳大利亚能源部长克里斯·鲍文(Chris Bowen)即将前往北京出席澳中气候变化部长级对话之际,透露澳大利亚将致力于提高在清洁能源投资领域中的份额。

-

Bowen Coking Coal(ASX: BCB)申请自愿停牌,推进债务重组与融资谈判

Bowen Coking Coal Limited(ASX: BCB)今日向澳大利亚证券交易所申请对公司证券实施自愿停牌,以支持当前关键债务重组及融资安排的推进工作。

-

提前完成财年煤炭产量指引的Bowen Coking Coal(ASX:BCB)最新市值千万澳元 停牌以推进融资安排

停牌前Bowen Coking Coal(ASX:BCB)大幅下挫,最新$0.096澳元股价对应市值在1,000万澳元左右,和2022年数亿澳元市值形成鲜明对比。

-

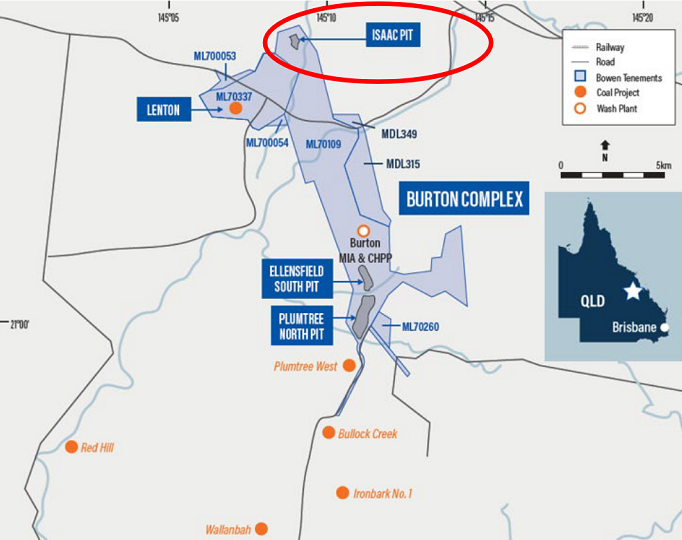

【异动股】Bowen Coking Coal (ASX:BCB)昆州Burton综合体北部矿坑煤炭资源量储量大幅扩增

Bowen Coking Coal Ltd (ASX股票代码:BCB) 位于昆州中部中鲍文盆地的Burton煤炭矿山综合体迎来资源量扩增的积极消息,综合体北端Isaac矿坑的煤炭储量和资源量分别增长170万吨和240万吨,推动整个项目总的煤炭储量和资源量分别达到1650万吨和1.107亿吨。

-

【异动股】Bowen Coking Coal (ASX:BCB) 飙涨14%:产煤成本持续下降 稳态经营策略显效

昆州煤炭生产商Bowen Coking Coal Ltd (ASX股票代码:BCB) 季报显示,今年第三季度公司共生产毛煤近77万吨、商品煤44万吨。当季共销售煤炭41.5万吨,受市场行情影响,实际平均售价同比下降5%,至216澳元每吨。

-

【9.18】今日财经时讯及重要市场资讯

9月15日,澳中博览会在墨尔本会展中心盛大开幕,这一重要活动受到了澳中两国政商的大力支持。澳大利亚前贸易部长Andrew Robb担任澳中博览会主席并致辞,中国驻墨尔本代总领事曾建华出席并发言。

免责声明:本网站信息仅供一般参考,不构成投资或财务建议。虽力求准确与完整,但不保证信息的准确性、完整性或时效性。投资有风险,决策前请咨询专业独立顾问。使用本网站即视为接受本免责声明。

热门点击

-

- 【1.20】今日财经时讯及重要市场资讯

-

- 【1.22】今日财经时讯及重要市场资讯

-

- 美欧关税新变量叠加高位行情 全球股市面临阶段性再定价

-

- 【1.21】今日财经时讯及重要市场资讯

-

- 【1.19】今日财经时讯及重要市场资讯

-

- 【异动股】稀土股ASM单日暴涨119%! 美国关键矿产公司Energy Fuels计划以1.2倍溢价收购Australian Strategic Materials (ASX:ASM)

-

- 美国加征关税,欧盟拟反制——跨大西洋博弈观察

-

- 【异动股】中国新生儿数据发布后 奶粉股The a2 Milk Company (ASX:A2M)盘中暴跌逾14%

-

- 逆势增长考虑分红! Yancoal兖煤澳大利亚(ASX:YAL))四季度产销双旺 现金余额突破21亿澳元

-

- 【异动股】中国新生儿数据发布后 奶粉股The a2 Milk Company (ASX:A2M)盘中暴跌逾14%

-

- TELIX Pharmaceuticals (ASX:TLX) 前列腺癌成像剂新药申请获中国药品监管机构受理

-

- 铀矿板块获麦格理持续看涨 2026年将迎 “开发者之年” 人工智能需求激发长期机遇

-

- 中澳铁矿石谈判进行时:必和必拓力拓罕见联手开采西澳铁矿石

-

- 【异动股】稀土股ASM单日暴涨119%! 美国关键矿产公司Energy Fuels计划以1.2倍溢价收购Australian Strategic Materials (ASX:ASM)

-

- 【异动股】铀价强势上涨 Paladin Energy (ASX:PDN)四季度产量大增 积极布署资源扩张