China-Australia service trade, a sophisticated symphony

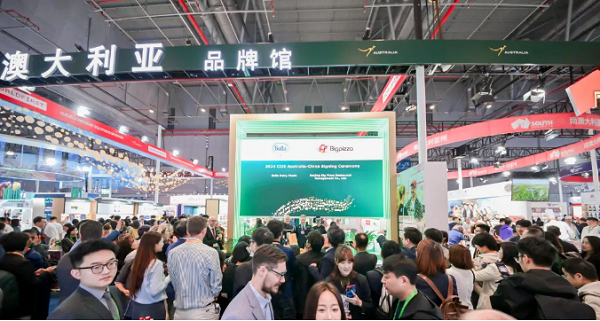

The 2024 China International Fair for Trade in Services (CIFTIS) provided Australian companies with a platform to showcase strengths in the green economy, education, and training.

(Image : Austrade official website)

By Peijin Zhang

When the 2025 China International Fair for Trade in Services (CIFTIS) opens in Beijing on September 10, Australia, the guest country of honor this year, will bring its largest-ever delegation to the event.

CIFTIS is the world’s largest fair dedicated to the promotion of trade in services. Since its inception in 2012, it has brought together enterprises from around the world to share opportunities from China's opening up, vast market and development of trade in services.

This year’s Australian participation will be unprecedented in scale, with both its exhibition space and participant count setting a new record. The Australian pavilion will double in size from last year’s, featuring over 60 companies.

According to Nick Henderson, regional general manager for Greater China at Tourism Australia, the exhibitors will highlight Australia’s leadership across a broad range of sectors — including green economy, education, tourism, consumer goods, and healthcare — and seek to explore and deepen cooperation with Chinese partners. Key participants include ANZ, CPA Australia, the University of Adelaide, and Tourism Australia.

Australia’s role as the guest country of honor is far more than ceremonial; it is a powerful testament to the maturation and diversification of the economic relationship between China and Australia. It signals a strategic pivot from a traditional trade dynamic to a more sustainable and deeply integrated partnership built on interaction, innovation, and services.

China is Australia's largest two-way trading partner, accounting for 26 percent of Australia’s global goods and service trade in fiscal year 2023-24. Its goods and service exports to China totaled AU$ 212.7 billion ($139.49 billion) in 2023-24. Service exports were up by a whopping 42.3 percent in the same period.

China-Australia service trade is flourishing, driven by complementary strengths and shared economic interests. This year’s CIFTIS is a great opportunity for Australian service providers to interact with and showcase their capabilities to prospective customers in China.

Australia’s service industry, renowned for its excellence in education, tourism, finance, and healthcare, aligns seamlessly with China’s growing demand for high-quality services.

Australia has long been a premier destination for Chinese students seeking high-quality tertiary education and a multicultural experience. Universities have moved beyond simple student recruitment to establish deep institutional partnerships.

A prime example is the University of Technology Sydney and its extensive research collaboration with Shanghai University and other Chinese institutions in fields like biomedical engineering and data science, creating new intellectual property and tackling global challenges together.

Tourism is also a success story. Chinese visitors are drawn to Australia’s unique landscapes, wildlife, and cosmopolitan cities. The recovery of international travel is reinstating this vital people-to-people link.

And the model is evolving. It’s no longer just about volume; it’s about value and specialization. Australian tour operators are collaborating with Chinese platforms to develop high-end experiences, catering to the sophisticated demands of Chinese travelers.

Financial services represent another area of joint collaboration. Australian financial institutions have expanded their presence in China, leveraging opportunities presented by China opening its financial markets.

For example, companies listed on the Australian Stock Exchange have partnered with Chinese fintech firms to develop innovative solutions for cross-border payments and investment platforms. These partnerships not only enhance efficiency but also pave the way for greater integration of the two economies.

Healthcare and aged care services are emerging as key areas of cooperation as well. Australia’s expertise in healthcare management and digital health solutions is highly sought after in China, where an aging population and rising healthcare demands require advanced services. Joint ventures between Australian and Chinese companies have already begun to address these needs, combining Australian innovation with China’s vast market reach.

The potential for Sino-Australian service trade remains vast. Digital services, including e-commerce, cybersecurity, and cloud computing, offer new avenues for collaboration. Australian tech companies, known for their creativity and adaptability, can partner with Chinese giants to explore opportunities in these fields.

Additionally, environmental services and sustainable development solutions are gaining traction, aligning with both countries’ commitments to climate action.

In the critical field of environmental services, Australia’s expertise in water management, waste treatment, and sustainable urban planning is in high demand as China pursues its dual carbon goal — peaking carbon dioxide emissions before 2030 and achieving carbon neutrality by 2060. Australia’s sustainable building practices that are environmentally responsible and resource-efficient will be in high demand.

By combining Australia’s strengths in high-quality services with China’s unparalleled market scale, digital innovation, and manufacturing prowess, the two nations can co-create services and products for each other and beyond. This is the profound opportunity that CIFTIS represents — a chance to compose a new and more sophisticated symphony of trade, conducted in harmony for mutual benefit.

Against the backdrop of rising global protectionism, Australia’s enthusiastic participation with other countries will send a strong signal of opposing trade protectionism and supporting free trade, underscoring the irreversibility of economic globalization.

Author: Peijin Zhang, a Beijing-based current affairs commentator

Disclaimer

The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. While every effort is made to ensure accuracy, we do not guarantee the completeness, reliability, or timeliness of any content. Investment involves risk. Always seek independent, professional advice before making any financial decisions.

相关阅读

-

澳媒中国进博会观察:美中局势无阻信心 澳企加倍押注中国市场

上周于上海举行的中国国际进口博览会上,从葡萄酒和牛肉生产商,到欧泊宝石和牛奶出口商,来自各个行业的澳洲企业均表示,尽管中美贸易争端带来的持续影响引人担忧,但中国消费者的需求正在反弹,购销渠道也畅通无阻。

-

【11.5】今日财经时讯及重要市场资讯

据澳大利亚贸易和旅游部声明,该部部长唐方睿已率澳大利亚企业代表团赴上海参加中国国际进口博览会(下称进博会)。据悉,此次参加进博会的澳大利亚企业达256家,创下历史新高。

-

第八届中国国际进口博览会今日开幕 澳大利亚品牌馆携180余家企业亮相上海

由中国商务部和上海市人民政府联合主办,中国国际进口博览局和国家会展中心(上海)有限责任公司承办的第八届中国国际进口博览会(以下简称“进博会”),将于2025年11月5日至10日在上海盛大举办。

-

澳贸易部长率企业代表团赴上海参加进博会

据澳大利亚贸易和旅游部声明,该部部长唐方睿已率澳大利亚企业代表团赴上海参加中国国际进口博览会(下称进博会)。据悉,此次参加进博会的澳大利亚企业达256家,创下历史新高。

-

澳大利亚品牌齐聚上海!

由中国商务部和上海市人民政府联合主办,中国国际进口博览局和国家会展中心(上海)有限责任公司承办的以进口为主题的国家级博览会 — 第八届中国国际进口博览会(以下简称“进博会”)将于2025年11月5日至10日在上海举办。

-

【澳中观察】 中澳服务贸易:一首精妙和谐的交响曲

2025年中国国际服务贸易交易会(简称“服贸会”)于9月10日在北京开幕,作为今年的主宾国,澳大利亚将派出有史以来规模最大的代表团参与本届盛会。

-

多组“链博”数据折射中国市场磁吸力

第三届中国国际供应链促进博览会闭幕新闻发布会7月20日举行。中国证券报记者从发布会上获悉,本届链博会亮点纷呈、成果丰硕,国际范、创新力、链接度进一步提升,为促进供应链合作作出积极贡献,为全球贸易发展注入新动能。

-

【新华全媒头条】团结才能共赢 携手方可共进——中国以高水平对外开放为世界经济注入暖流

今年年初以来,单边主义、贸易保护主义抬头,地缘政治风险加剧,拖累世界经济增长预期,对全球复苏构成严峻挑战。与复杂的外部环境形成鲜明对比,中国积极推动各方合作共赢。以“链接世界、共创未来”为主题,第三届中国国际供应链促进博览会16日在北京开幕。

免责声明:本网站信息仅供一般参考,不构成投资或财务建议。虽力求准确与完整,但不保证信息的准确性、完整性或时效性。投资有风险,决策前请咨询专业独立顾问。使用本网站即视为接受本免责声明。

热门点击

-

- 上市不足两月Moonlight(ASX: ML8)交出首轮钻探数据 Clermont金矿14个钻孔全部见矿 多个外延钻孔持续见矿 矿化边界尚未显现

-

- 大宗商品热潮拉动价值型股票走出困境 高盛看好13只价值股称后市可期

-

- 【1.29】今日财经时讯及重要市场资讯

-

- 【1.27】今日财经时讯及重要市场资讯

-

- 上市不足两月Moonlight(ASX: ML8)交出首轮钻探数据 Clermont金矿14个钻孔全部见矿 多个外延钻孔持续见矿 矿化边界尚未显现

-

- 【1.28】今日财经时讯及重要市场资讯

-

- 250位矿业与投资大佬汇集 Resourcing Tomorrow 将于4月首次在香港举办

-

- 【异动股】热门稀土股Energy Transition Minerals (ASX:ETM) 披露对格陵兰和丹麦政府平行诉讼最新进展 股价回落逾10%

-

- 人工智能数据公司澳鹏Appen(ASX:APX)中国业务营收飙升 扭亏为盈战略初见成效

-

- “重量级一周”开启! 美股科技巨头财报集中来袭 业绩牵动市场神经

-

- 【1.30】今日财经时讯及重要市场资讯

-

- 军工股 Electro Optic Systems (ASX: EOS)发布最新季度运营更新 订单储备4.59亿澳元 同比增长238%

-

- 【异动股】Critica (ASX: CRI) 盘中暴涨70%:Jupiter磁性稀土项目获券商研报覆盖

-

- 铀矿板块获麦格理持续看涨 2026年将迎 “开发者之年” 人工智能需求激发长期机遇

-

- 传BlueScope博思格(ASX:BSL))接洽日韩钢铁巨头 谋求抗衡SGH财团132亿澳元投机性收购要约