【Stock on the Move】Solstice Minerals (ASX: SLS) Reports Strong Nanadie Copper-Gold Drill Results; Shares Surge 157.14% Last Week

By David Niu | ACB News

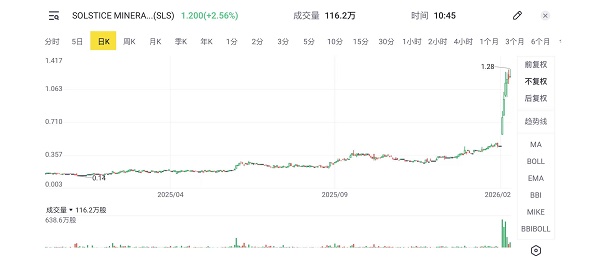

ACB News (9 February 2026) — Despite heightened volatility across the Australian share market last week, Western Australia-focused gold and copper-gold explorer Solstice Minerals Limited (ASX: SLS) delivered standout performance after releasing its latest exploration update, with the company’s share price recording a sharp rise over the week.

Solstice Minerals (ASX: SLS) share price chart screenshot

Source: Tiger Trade App

Last Tuesday, Solstice announced a new batch of drilling results fromits Nanadie Copper-Gold Project, attracting strong market attention. The stock moved sharply higher over the week, delivering a weekly gain of approximately 157%.

According to the exploration update released by the company, Solstice’s ongoing resource extension drilling program at Nanadie has delivered its first set of results, with multiple drill holes intersecting broad, high-grade copper-gold mineralisation. Several mineralised intervals were also recorded outside the boundaries of the current resource model, indicating potential for further resource expansion.

The reported results relate to the first five drill holes of a planned 23-hole reverse circulation (RC) drilling program designed to test extensions beyond the existing Mineral Resource Estimate (MRE). The company stated that the mineralised system remains open in multiple directions and that drilling continues.

Multiple Holes End in Mineralisation

High-Grade Intercepts Extend Beyond Existing Resource Boundary

Key drilling highlights include:

62 metres at 1.55% copper and 0.66 g/t gold, including

22 metres at 2.78% copper and 1.25 g/t gold (Hole: NANRC004); and

97 metres at 0.73% copper and 0.30 g/t gold (Hole: NANRC001).

Solstice noted that some drill holes remained mineralised at the planned end-of-hole depth, indicating the copper-gold system remains open at depth. The company also confirmed that several high-grade intercepts were achieved outside the existing JORC resource model, providing further support for the project’s resource growth potential.

Resource Overview

The Nanadie Copper-Gold Project currently hosts a JORC 2012 Inferred Mineral Resource of 40.4 million tonnes, containing approximately 162,000 tonnes of copper and 130,000 ounces of gold. Solstice stated that the latest drilling results confirm mineralisation continuity beyond the current resource boundary, and the new data will be used to guide follow-up drilling and further resource evaluation work.

In terms of mineralisation style, Nanadie is characterised by broad zones of large-scale disseminated copper-gold sulphide mineralisation. The company noted that the project’s scale and development potential will require further drilling and technical studies for verification.

(Image source: ACB News)

Further Assay Results Pending

Solstice stated that the drilling program remains underway, with assay results from the remaining 18 RC drill holes expected to be released progressively over the coming weeks. The company said these results will assist in planning the next stage of drilling and assessing the potential for a future resource update.

As at the end of December 2025, Solstice reported cash reserves of approximately A$13.4 million, and stated that its current funding position supports continued exploration activities at Nanadie and across its broader Western Australian portfolio.

Secondary Market Share Price Performance

In the secondary market, Solstice Minerals’ share price recorded significant movement last week following the announcement. After the drilling update was released on Tuesday, the stock opened with a price gap and trading volume increased. Over the following sessions, the share price continued to rise as turnover remained elevated.

By last Friday’s close, Solstice Minerals was trading around A$1.17. Based on this level, the company’s share price increased by approximately 157.14% over the week.

ACB News Has Been Tracking Solstice Since Early Exploration Updates

Solstice Minerals first came onto ACB News’ radar following exploration updates released in March 2025, when the company’s share price was trading around A$0.18. (See ACB News report published on 20 March 2025: “Cash Balance of A$15.18M at Quarter End, Market Cap A$18.06M — Solstice Minerals (ASX: SLS) Bluetooth Targets 800m Shallow Gold Mineralised Trend”.)

ACB News has since continued to follow the company’s progress, including a series of reports published in June 2025 covering the Bluetooth discovery and institutional placement developments, including:

“Solstice Minerals (ASX: SLS) Bluetooth Mineralised Gold System Extends Over 800m; Shares Hit Three-Year High”

“Solstice Minerals (ASX: SLS) Receives Paradice Commitment for A$2.13M Placement, Completion Expected 20 June”

Less than a year later, following the latest exploration update, Solstice Minerals’ share price has risen to A$1.17, representing an increase of more than 550% compared with its level in March 2025.

( Data source: This article is based on publicly available disclosures released by Solstice Minerals Limited (ASX: SLS), including its December 2025 Quarterly Activities Report and recent exploration announcements.)

Copyright Notice

All articles labeled as “Original” on ACB News (澳华财经在线) are protected by copyright.

Any reproduction, republication, redistribution, or adaptation of such content, in whole or in part, in Australia or elsewhere, without prior written authorization from ACB News, is strictly prohibited and constitutes copyright infringement.

相关阅读

-

【2.9】今日财经时讯及重要市场资讯

上周末澳首府城市房拍市场上买家表现踊跃,使得初步清盘率达到自去年春季销售旺季以来最高水平。专家认为央行加息的影响可能有限,市场仍将保持强劲势头。

-

Solstice Minerals(ASX:SLS)公布 Nanadie 铜金项目强劲钻探成果 上周股价劲升157.14%

尽管上周澳股出现大幅波动,但西澳黄金及铜金勘探公司 Solstice Minerals Limited(ASX:SLS) 在上周公告勘探最新进展后,股价表现惊艳。

-

Solstice Minerals (ASX: SLS) Receives Paradice Commitment for $2.13M Placement, Completion Expected 20 June

Solstice Minerals Limited (ASX: SLS) announced on Monday that it has received a firm commitment from institutional investor Paradice Investment Management for a $2.13 million strategic placement. Upon completion, Paradice will become the company’s largest shareholder, holding a 9.90% stake.

-

Solstice Minerals(ASX: SLS)获Paradice认购承诺 拟于6月20日完成213万澳元定向增发

今日发布增发消息的 Solstice Minerals(ASX: SLS)股价早盘创出上市以来新高0.30澳元。西澳黄金矿产勘探公司 Solstice Minerals Limited(ASX: SLS) 周一宣布,公司已收到来自知名机构投资者 Paradice Investment Management 的认购承诺,拟通过战略定向增发方式融资约 213万澳元。交易完成后,Paradice 将成为公司 第一大股东,持股比例达 9.90%。

-

【6.16】今日财经时讯及重要市场资讯

以色列对伊朗关键核设施发动空袭,引发全球市场对核能资源的关注,澳交所(ASX)铀矿概念股周一(6月16日)集体强势上扬,涨幅居各板块前列。在当前地缘政治紧张与能源安全并重的背景下,铀矿板块再度成为市场焦点。

-

澳大利亚股市周三早盘创出历史新高 ASX200指数触及8639点 板块个股渐趋活跃

澳大利亚股市在周三早盘交易中ASX 200指数触及8639点,突破本年2月14日“情人节”创下的前期高点8615点,刷新该指数历史新高。本周以来,市场明显一大亮点是——CBA联邦银行等权重股保持稳健上行同时,矿业板块个股活跃度明显回升。

-

Solstice Minerals(ASX: SLS)Bluetooth矿化金床延伸超800米! 本周股价创出上市3年来新高

澳交所黄金勘探公司Solstice Minerals Ltd(ASX: SLS)上周发布旗下勘探项目进展公告,其位于西澳东金矿带(Eastern Goldfields)的Bluetooth(金矿)靶区第二阶段RC钻探取得多段浅层连续金矿化结果,进一步确认该区域具备构建初步资源基础的潜力。

-

【6.6】今日财经时讯及重要市场资讯

美国关税政策不确定性持续扰动全球市场的背景下,花旗重点关注澳交所一些中小型公司,认为这些公司将通过“颠覆性战略”为投资者提供高增长机会。

免责声明:本网站信息仅供一般参考,不构成投资或财务建议。虽力求准确与完整,但不保证信息的准确性、完整性或时效性。投资有风险,决策前请咨询专业独立顾问。使用本网站即视为接受本免责声明。

热门点击

-

- 澳洲养老金行业暗流涌动 AusSuper等行业基金巨头成员显著流失 零售财富平台强力吸金

-

- 【异动股】高能激光武器制造商Electro Optic Systems (ASX:EOS) 遭遇做空报告:韩国军事合约被指管理层刻意误导 隐藏“黑暗现实” EOS股票停牌有待回应

-

- Solstice Minerals(ASX:SLS)公布 Nanadie 铜金项目强劲钻探成果 上周股价劲升157.14%

-

- 亚洲资本聚焦矿产资源“主战场”:Resourcing Tomorrow Hong Kong 2026年4月香港盛大启幕

-

- 【2.9】今日财经时讯及重要市场资讯

-

- 美股观察:新高之后 道指何去何从?——周期、浪型与趋势的最新研判(一)

-

- 悉尼Top 10私立学校学费不断上涨 学业成绩却多数下滑

-

- 【2.10】今日财经时讯及重要市场资讯

-

- 宝武:澳钢铁公司InfraBuild对其旗下子公司加征关税提议毫无根据且“出于自利”

-

- 【异动股】红酒巨头Treasury Wine Estates (ASX:TWE)遭瑞银下调股票评级至“卖出” 股价承压重挫8%

-

- 全球粮食供过于求挤压利润表现 澳谷物处理巨头GrainCorp盈利预警股价暴跌

-

- 澳CBA联邦银行将澳大利亚列为最佳人工智能投资目的地 ASX数据中心股票集体飙升

-

- RBA澳储行就经济增长发出严肃警告 中期经济增速仅1.6% 政府预算面临严峻考验

-

- “过上更简单的生活”:疫情后购房需求变迁 澳洲地方城镇郊区房价年涨幅最高接近50%

-

- 商界领袖敦促澳政府削减500亿澳元支出 减轻通胀压力避免利率上行